Valens Company (OTCQX:VLNCF) is predominantly a white-label manufacturer based in Canada. If you want to become a cannabis producer and put a label on your product all you have to do is get a license from the provincial government in Canada. Then, Valens will put together the formula for what you are looking for in your cannabis company; It then packages your product and sends it to wherever you need, which would be a dispensary of your choice, presumably. Then, once all of the heavy lifting was done, all you would do is market your product and sell it to your customers. It is simplistic, but that is really all it takes.

On some level, I am at odds with this business model, and yet I think it is pure genius. White-label manufacturing is available in nearly every industry in existence. And, with retail basically all but dead, a business model where the only thing you do is basically market your product on Instagram and have your followers buy through your website makes all the sense in the world.

I have been reading that a lot of the Canadian cannabis companies are putting retail stores on their websites because there are more margins in an online store. Given that, having Valens Company be the producer of these products for a multitude of customers would keep costs down.

While I do not consume cannabis in any form myself, I certainly know a few who do. These individuals will go on endlessly about their favorite brands and how a particular strain can affect a person in a certain way that they enjoy.

This begs the question: Can Valens Company produce enough of a variety at a high enough quality level for each company that these companies can thrive on their own?

This is where on a philosophical level, I am at odds with white-label manufacturing for cannabis. There is something to be said about the smaller company that is putting out a quality product consistently and garnering accolades and a legion of followers. Then again, Valens is selling quite a lot of white-label products to companies, so maybe there is more merit than I am willing to believe.

Given that, I'll break down Valens Company and see if it is worthy of putting into my portfolio.

Canadian Cannabis Industry

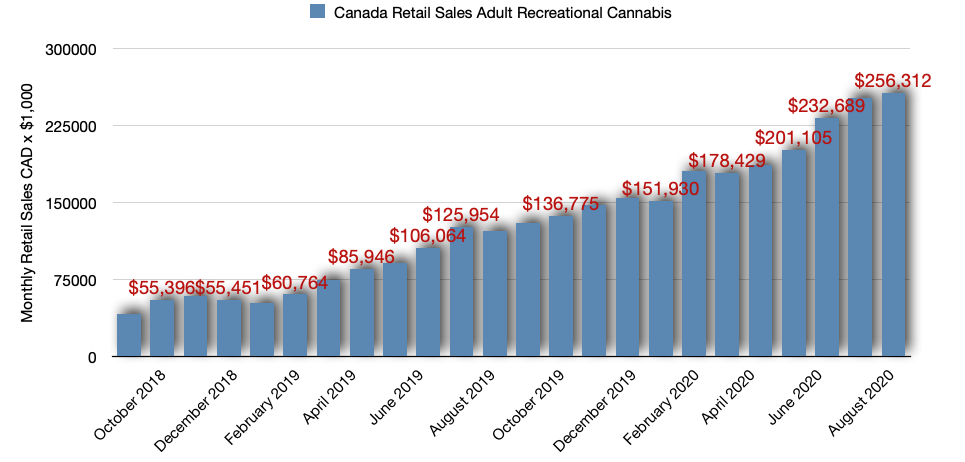

Here is a fun fact about cannabis: mail-ordering cannabis is something that Canadians have enjoyed for some years since legalization. Remember, in Canada, it is legal federally and therefore companies can mail out products to customers. Not so in the United States, although there is debatability on this issue. But, until the Federal government legalizes cannabis in the United States, this luxury is simply not available yet. Given Canada's advantage, here is a look at Canadian cannabis sales since its legalization in October 2018:

(Data Source: StatCan - Author's Chart)

As you can see, the trend line is upward and has been increasing since its inception. However, I want to point out that a significant portion of cannabis in Canada is sold through dispensaries and not mail-ordered, or at least it was until the world was shut down by COVID and mail-order of nearly everything has now become pervasive across every industry as recent data from holiday sales show.

I recently received an email from a contact within the cannabis industry who stated that their mail-order business has been shooting through the roof since the lockdown. I'm not sure if that is just this particular company or a decent tone across the industry. And, wouldn't you know it, this individual's products were made by Valens Company via a white-label agreement. His products are available exclusively online; he does not have any dispensaries he deals with.

This is where I continue to be at odds with this type of business. This company's products are ingestible, not smokable. Therefore, the effects are slightly different and it is easier to get a consistent product.

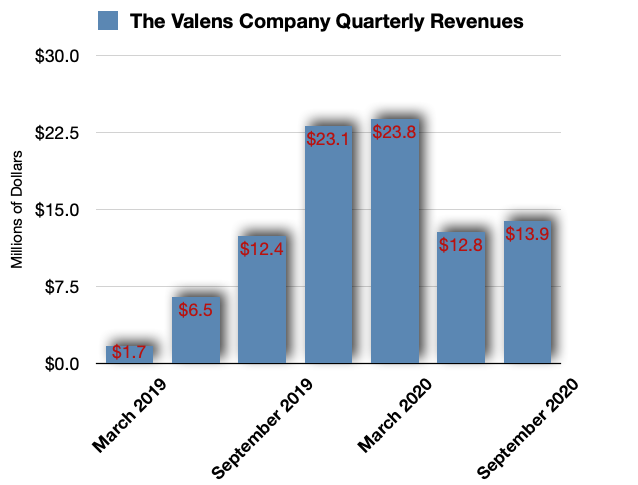

Valens Company Revenue

Despite the increases in some individual company's results during the lockdown, Valens Company revenues are down during the COVID pandemic, as noted by the company in its previous earnings release press statement:

(Data Source: Valens Company - Author's Chart)

Q2 earnings release for the period ending on May 31st were issued previously and this is where the company focused its attention on the revenue decline. As it states, on the one hand, the shutdown limited its ability to extract and process. On the other hand, it is seeing increased orders for its white-label packaging process.

I am going to chalk that up as an opportunity in the sense that if orders are increasing, then revenues will eventually increase to levels above the pre-pandemic level. The only variable would be the ability for Valens Company to actually process its products, extracting and filtering the products to enable the sales to go through.

Logistically, companies have been hindered by the pandemic. However, everyone is adjusting in some capacity or another. Should Valens Company finally adjust in a manner that allows for 100% operational capacity, and orders continue to increase as they are, then this could be a potential opportunity for the company.

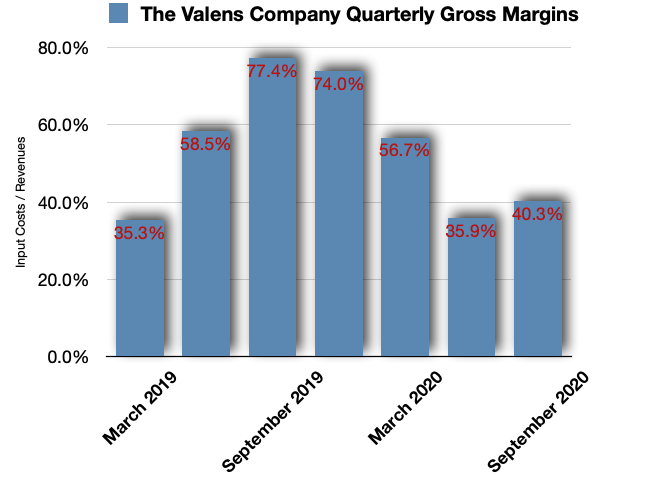

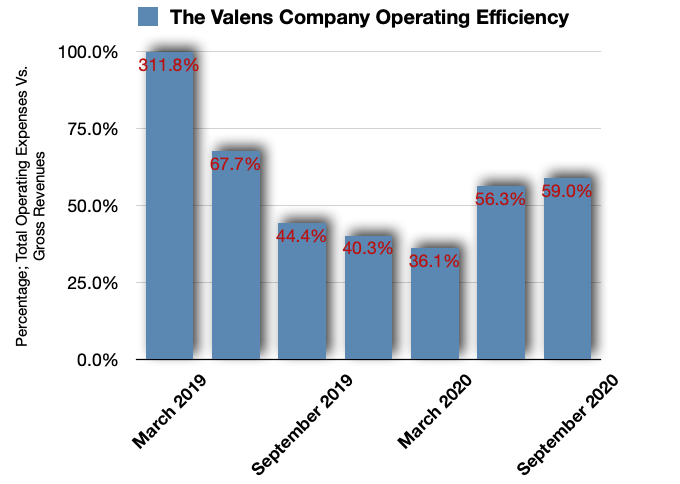

Valens Company Margins and Operating Efficiencies

Gross margins and operating efficiencies are some of my most favored indicators to check on a company. I want to see that the company is managing its costs effectively. Here are both, respectively, for Valens Company:

(Data Source: Valens Company - Author's Chart)

(Data Source: Valens Company - Author's Chart)

Operating efficiencies are high but, that is also a factor of economies-of-scale. First, the costs of goods would be 59.7% since gross margins are at 40%. Given a 59% operating cost, adding up to 118.7% total, there is no way for the company to be profitable. However, if we go back a few months to earlier quarters when the company had higher revenues and lower operating efficiencies, you can see that this is dispositional during the lockdown.

The company has stated its concerted effort in the most recent earnings release to address costs. And, if there are simultaneously increased revenues with the orders that Valens Company has seen in recent months, along with decreased costs, I believe that Valens will return to profitability quickly. It is just a matter of increasing the revenues lost to the lockdown due to the inability to process its product. I am looking for this company to get there quickly, in fact.

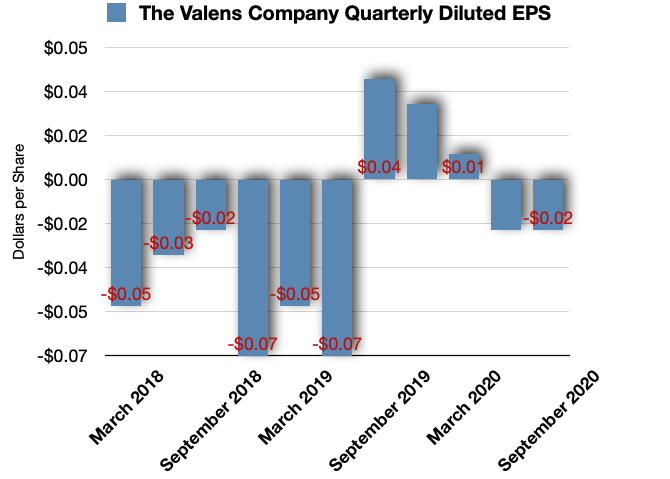

Valens Company Net Income

Here is the net income for Valens:

(Data Source: Valens Company - Author's Chart)

Despite the negative numbers in costs, Valens is close to profitability. Again, you can see where economies of scale had the company profitable just two quarters ago.

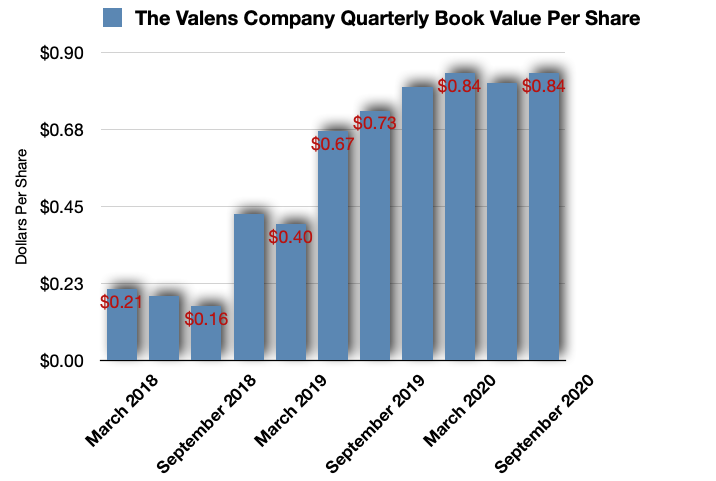

Valens Company Book Value

I gauge a company's book value as a benchmark to allow a margin of safety as an investment. If all else fails, and you dismantled the company, what would you possibly get? From that, if the company's book value is in line with the stock price and it allows for some kind of margin of safety with an investment, this is where you would look to find that:

(Data Source: Valens Company - Author's Chart)

The last I checked, the stock was trading at $1.35. The stock is above book value by a solid 60%. The industry has been beaten up over the past year. After a lot of investors rushed into the industry looking for green gold, prices were pushed to irrational valuations. The requisite returns on investment never materialized and a lot of investors sold out. Stocks pushed lower all the way down throughout the industry.

Because of that, as I move through some 600 or so cannabis stocks I am finding many companies with their stock prices far below book value. That makes a decision easier. Having a book value below the stock price is not the norm at this time in this industry. It makes a decision a little more tricky, but not impossible.

Valens was profitable before the lockdown. So, then one could value the company on forward earnings alone and hope that management built up a solid base of assets to work from while simultaneously keeping liabilities low. So, the fact that Valens' stock is above its book value is merely a case of leftovers from the previous quarters' positive returns. If Valens were to quickly return to profitability, I believe this stock would head higher. However, I am reluctant to believe that there is enough of a catalyst at this point to brush this aspect aside and push forward with a buy. At least, not right now.

VLNCF Stock

Here is a look at the chart on Valens Company:

(Data Source: TradingView)

As I said, the industry has been rocked, but it's bouncing back. The recent election results pushed some stocks upward. But I think that's nuts, really. A Biden victory by itself is not enough to push through any legislation legalizing cannabis. Remember when Obama had a Republican House of Representatives majority and they pushed through countless measures trying to repeal Obamacare. It was purely ceremonial, in my opinion. There seems to be an echo. So, while there was some kind of bump in the markets from November, and possibly the Houses vote on a bill that went nowhere, I'm not so sure that this was a catalyst for a big move in the cannabis stocks. Instead, some companies have actually been printing profits.

If we go back to EPS with Valens, the company printed an EPS for one quarter of $0.04. With a full year of this kind of earnings, and at the current average for the market of 30x future earnings, this would put the stock price above $4.00. It is currently about $1.35. That is a significant increase. And, that is significant potential.

The Takeaway: Is Valens Company a Buy?

I am very bullish on the cannabis industry. This portfolio I am putting together is mostly cannabis pure-play. Valens would fit that criteria and I could see the company returning to profit at some point in the future. The company printed 3 quarters of profits, and then COVID.

Given the opportunity for this company to turn around quickly, I am bullish on the stock. Its costs have already proven to be contained enough to achieve profitability. And, given the current environment, the company is pushing for more cost measures. Once revenues return to moving upwards, this prudence is likely to continue; making the company even more profitable.

One of the variables I have seen is that companies are focusing on branding their own products instead of just producing wholesale cannabis for other companies. This has begun to pay off for these companies; the margins are bigger. This isn't the business plan for Valens. Although the company has already been profitable, it is missing this as an opportunity by merely focusing on being a processor of cannabis. I do not think this in itself becomes a strong enough rationale to exclude it from my portfolio.

Nonetheless, I believe this stock will move higher. I am bullish. But, I am going to hold off on adding it for the moment and keep it on my radar. I'm looking for a strong catalyst to push me to hit the buy button.

That being said, if someone already has this stock in their portfolio, I think they will be doing well in the coming future.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in VLNCF over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

December 18, 2020 at 10:41AM

https://ift.tt/2WxLtPD

Valens Company: The Undervalued White-Label Company Will Return To Profitability - Seeking Alpha

https://ift.tt/3fbzbE8

Bagikan Berita Ini

0 Response to "Valens Company: The Undervalued White-Label Company Will Return To Profitability - Seeking Alpha"

Post a Comment